Coming at a time when 5 states are due to go to polls in a month, many expected the budget for 2022-23 to have a populist outlook with huge incentives and welfare schemes. Also, given the near record unemployment levels, there was an expectation for a massive push in spending on big-ticket projects to create jobs. In one of the shortest budget speeches ever, Finance Minister, Nirmala Sitharaman finally presented the Union Budget for 2022-23 yesterday billing it as a "Blueprint to steer the economy from India@75 To India@100". Ms. Sitharaman said that her goal was to complement macro-growth with micro-all-inclusive welfare, digital economy and fintech, tech-enabled development, energy transition, and climate action.

While some have hailed the budget as ground-breaking, many have panned it citing that it would do little to promote employment and reduce inflation, the areas that are hurting India's poor the most. Let's begin by breaking down the Budget in numbers and analysing each component individually.

Receipts (Where will the money come from?)

This is the money received by the government from tax and non-tax sources to enable it to undertake government expenditures.

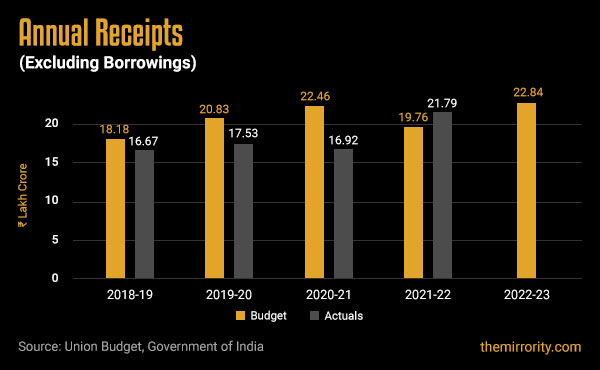

- The receipts (excl borrowings) in 2022-23 are budgeted at Rs. 22.84 lakh crore, 4.8% higher than the actual receipts estimated in 2021-22.

- The receipts (excl borrowings) in 2021-22 are expected to be higher than budgeted by Rs. 2.02 lakh crore (10.2% of the budgeted amount). The shortfall of Rs. 0.97 lakh crore in 2021-22 due to the missed disinvestment target was more than made up by a higher than budgeted collection of Rs. 2.99 lakh crore in taxes.

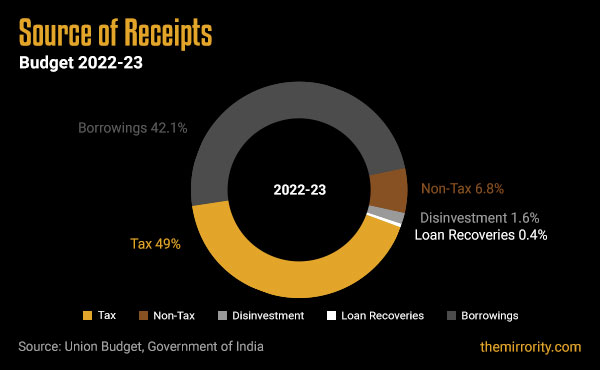

- Revenue from taxes (corporate, income, GST, customs & excise) is the government's largest source of revenue and is budgeted at Rs. 19.35 lakh crore (49% of the total receipts) in 2022-23

- Borrowings are the second-largest source of revenue and are budgeted at Rs. 16.61 lakh crore (42.1% of the total receipts) in 2022-23. The government's borrowing last year exceeded its budget by 5.6%.

- Revenue from disinvestments (sale of government's stake in public assets) is budgeted at Rs. 0.65 lakh crore (1.6% of the total receipts) in 2022-23. The government set an ambitious disinvestment target of Rs. 1.75 lakh crore in 2021-22 of which it is expected to meet just 45% while in 2020-21 it was able to meet only 18% of the budget. The poor track record in disinvestment is one of the biggest challenges that the government will face to manage the fiscal problems and fund the massive planned Capex growth.

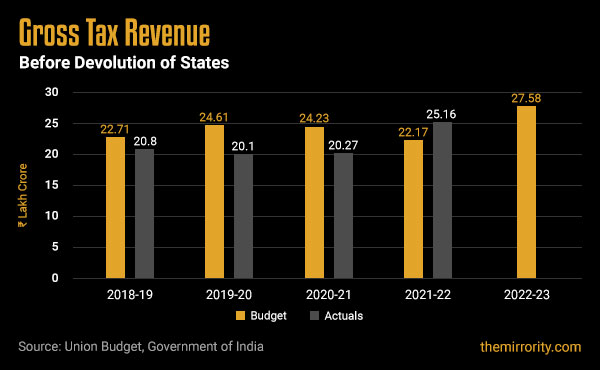

- The total tax collections in 2022-23 are budgeted at Rs. 27.58 lakh crore, 9.6% higher than the actual collections estimated in 2021-22.

- The gross tax revenue growth of 9.6% is lower than the estimated nominal GDP growth of 11.1% in 2022-23. This is primarily on account of a 15% decrease in excise duties.

- 51.5% of the total tax collections in 2022-23 are expected from direct taxes (corporate and income tax) while 48.5% are from indirect taxes (GST, customs duties, excise).

- The gross tax collections in 2021-22 are expected to exceed the budget by Rs. 2.99 lakh crore (13.5% of the budgeted amount)

- Rs. 8.17 lakh crore is budgeted for devolution to the states (their share of the Central taxes)

| Also read: India's Tax Revenues – Statistical insights and expert analysis |

Expenditure (How will the money be spent?)

Government expenditure includes spending on current goods and services (government consumption); government investment expenditures such as infrastructure investment or research expenditure; and transfer payments like unemployment or retirement benefits.

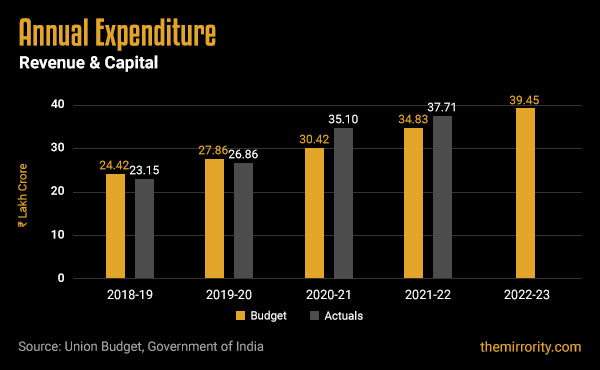

- The total government expenditure in 2022-23 is budgeted at Rs. 39.45 lakh crore, a 4.6% increase over the actual expenditure estimated in 2021-22.

- The actual expenditure in 2021-22 is estimated to exceed its budget by Rs. 2.87 lakh crore (8.2% of the budget). The areas contributing to the overspend are subsidies (0.97 lakh crore), ministry of civil aviation (0.69 lakh crore), tax administration (0.64 lakh crore), and urban development (0.19 lakh crore).

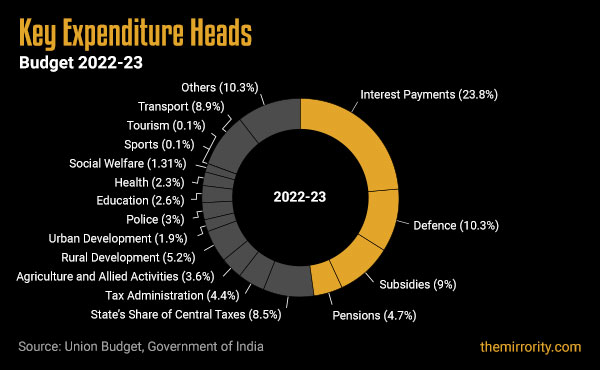

- 48% of the total government expenditure in 2022-23 is budgeted to be spent on 4 areas i.e. interest payments, defence, subsidies, and pensions.

- 23.9% (Rs. 9.4 lakh crore) is budgeted for interest payments towards servicing government debts in 2022-23. In comparison to 2014, the interest payments will have increased by 134% in 2022 owing to increased borrowings.

- 10.3% (Rs. 4 lakh crore) is budgeted to be spent on Defence in 2022-23, an increase of 5% over the estimated actual defence expenditure in 2021-22.

- 9% (Rs. 3.6 lakh crore) is budgeted for subsidies in 2022-23, a decrease of 17% over the amount of subsidies disbursed in 2021-22. A subsidy is a benefit given to individuals or businesses by the government in the form of a cash payment or a tax reduction, typically to alleviate the economic burden. The majority of the subsidies in 2022-23 are for Food (58%), Fertilizer (29.6%), and Petroleum (1.6%).

- 4.7% (Rs. 1.85 lakh crore) is budgeted towards Pensions in 2022-23. Of these, Rs. 1.2 lakh crore is for pensions for defence personnel. In addition to Rs. 1.85 lakh crore, an amount of Rs. 21,595 crore for pension is distributed within the respective department/ministry budgets thereby bringing the total spend on pension budgeted in 2022-23 to Rs. 2.07 lakh crore.

- 8.9% (Rs. 3.52 lakh crore) is budgeted for Transportation sector in 2022-23. Major spend is towards achieving the Gati Shakti objective - 25,000 kms of National Highways, 400 new generation Vande Bharat trains, and 100 cargo terminals for multimodal logistics facilities.

- 2.6% (Rs. 1.04 lakh crore) is budgeted for Education in 2022-23. As per the recommendations of National Education Policy in 1968 and re-iterated subsequently over the years, India needs to spend atleast 6% of its GDP on education. India's total public expenditure on education has remained between 2.8% to 3.1% of its GDP since 2013. Barring 2017-18, the government has been unable to fully utilize the education budget between 2016 and 2021.

- 2.3% (Rs. 0.89 lakh crore) is budgeted for Health in 2022-23, 0.7% higher than the estimated actual health expenditure in 2021-22. In comparison to its benchmarked G20 peers, India's total per capita expenditure on health in 2019 as a percentage of its GDP was amongst the lowest - 18% that of USA, 31% that of Brazil, and 55% that of China.

- Rs. 2,601 crore is allocated towards the Central Vista project. The amount will be used for the construction of non-residential office buildings, including the Parliament and Supreme Court of India.

- Only 0.06% (Rs. 2,400 crore) is budgeted for Tourism in 2022-23. Of this, Rs. 1,644 crore is earmarked for infrastructure development and Rs. 421 crore allocated towards promotion and publicity activities. Despite the Tourism industry employing between 8-10% of India's workforce, its share in the total expenditure has remained at or below 0.1% for the last 7 years.

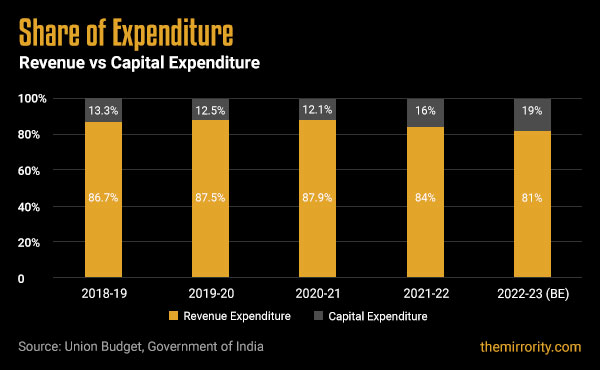

- 19% of the total planned expenditure in 2022-23 is towards capital expenses. Rs. 0.75 lakh crore is budgeted to be spent on capital projects. Key amongst them are Ministry of Road Transport & Highways (1.88 lakh crore), Defence Services (1.52 lakh crore), Ministry of Railways (1.37 lakh crore), Department of telecom (0.54 lakh crore), and Ministry of Housing and Urban Affairs (0.27 lakh crore).

- The share of actual capital expenses incurred in the overall annual expenditure has been steadily increasing - from 13.3% in 2018 to 19% budgeted in 2022.

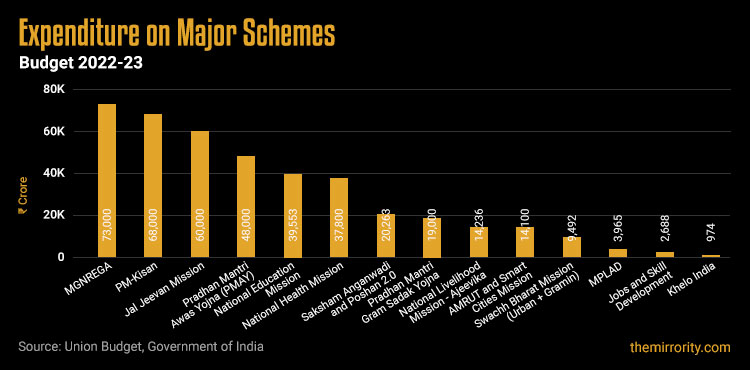

- Among major schemes, Mahatma Gandhi National Rural Employment Guarantee program (MGNREGA) has the highest allocation in 2022-23 at Rs. 73,000 crore, 25.5% lesser than the estimated actual expenditure in 2021-22.

- PM-KISAN scheme (income support to farmers) has the second highest allocation in 2022-23 at Rs. 68,000 crore, a Rs. 500 crore increase over the estimated actual expenditure in 2021-22.

- Allocation to the Jal Jeevan Mission (formerly known as the National Rural Drinking Water Mission) increased by 33% to Rs. 60,000 crore in 2022-23 for providing access to tap water to 3.8 crore households.

- Rs. 48,000 crore is allotted for PM Awas Yojana in 2022-23. As part of the scheme, 80 lakh houses will be completed for identified beneficiaries.

Fiscal Deficit

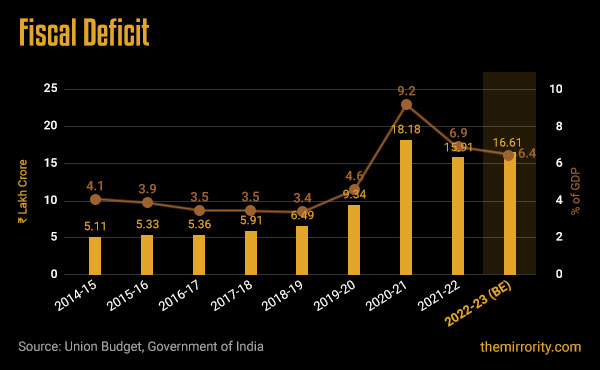

A government creates a fiscal deficit by spending more money than it takes in from taxes and other revenues (excluding borrowings). In other words, the Fiscal Deficit denotes the amount needed by the government to meet its operational and capital expenses (excl debt repayments). Thus a large Fiscal Deficit means a large amount of borrowings. The gap between income and spending is generally closed by government borrowing, reducing subsidies, disinvestment in PSUs, reduction in expenditure on staff bonus, etc. A prolonged period of revenue deficit adversely affects the credit rating of a government.

- Fiscal deficit in 2022-23 is budgeted to touch Rs. 16.61 lakh crore, equivalent to 6.4% of India's GDP. The deficit will be financed majorly by market borrowings (11.6 lakh crore) and securities against small savings (4.2 lakh crore). Rs. 19,000 crore will be raised through external debt.

- The fiscal deficit amount has been steadily increasing over the years - moving up from Rs. 5.03 lakh crore (4.5% of GDP) in 2013 to Rs. 16.61 lakh crore (6.4% of the GDP) budgeted in 2022.

Outstanding Liabilities

This is the amount owed by the Indian government to its internal and external creditors.

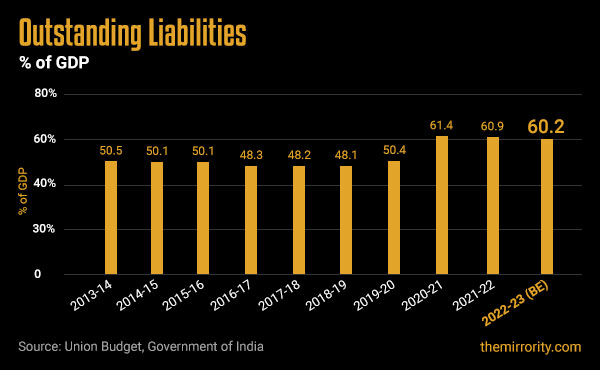

- Given the increased borrowings over the years, the total outstanding liabilities of the government are expected to be equivalent to 60% of its GDP in 2022-23.

- After remaining steady between 48-50% of its GDP between 2014 to 2019, the outstanding liabilities have increased by 10% over the last 3 years. This has correspondingly increased the interest burden - from Rs. 4.02 lakh crore in 2014 to Rs. 9.4 lakh crore budgeted in 2022-23.

| Also read: Union Budget – Statistical insights and expert analysis |

Other salient features of Budget 2022-23

- India's growth is estimated to be at 9.2%, the highest among all large economies. The economy is expected to grow to USD 5 trillion by FY 2026-27 in terms of nominal GDP.

- RBI to introduce its own digital currency in 2022-23. With a (possible) aim to discourage transactions in other cryptocurrencies and NFTs, profits from virtual digital assets will be taxed at 30%. Any loss from virtual digital assets will not be allowed to offset against other gains. Considering that there is currently no law on digital currency, implementation of this new tax may be challenging.

- Taxpayers will be allowed to file an updated return on payment of taxes within two years from the end of the relevant assessment year. As per the FM, the new provision will ensure voluntary tax filing and reduce litigation.

- Individual salaried taxpayers looking for an increase in tax relief under section 80C of the Income-tax Act, 1961 were left disappointed. This would effectively mean that individuals opting for the old tax regime for the financial year 2022-23 will continue to claim a maximum deduction of Rs 1.5 lakh in a financial year.

- Existing tax benefits for startups, which were offered redemption of taxes for 3 consecutive years, to be extended by 1 more year.

- The long-term capital gains will be capped at 15% which is expected to reduce tax for VCs and angel investors.

- 'One Nation, One Registration' will be established for anywhere registration to facilitate ease of living & doing business.

- Production Linked Incentive (PLI) schemes in 14 sectors with potential to create 60 lakh new jobs, and additional new production of Rs 30 lakh crore.

- Emergency credit line guarantee scheme (ECLGS) for small and medium-sized businesses to be extended to March 2023. This is expected to help banks mitigate their risk and also assist the MSME sector.

- Rs. 1 lakh crore will be provided in the form of 50-year interest free loans to states for boosting investment in the economy. In addition, states will be allowed 4% fiscal deficit to GDP in FY23

- Sovereign Green Bonds will be issued to fund the green infrastructure projects. The effective capital expenditure of the central government is estimated at Rs. 10.68 lakh crore rupees in 2022-23

- 100% of 1.5 lakh post offices will come on the core banking system, enabling financial inclusion and access to accounts through net banking, mobile banking, ATMs, and also provide online transfer of funds between post office accounts and bank accounts. This will be helpful especially for farmers and senior citizens in rural areas, enabling inter operability, and financial inclusion.

- Defense R&D will be opened up for industry, startups and academia. 68% of capital procurement budget in defence will be earmarked for domestic industry (up from the 58% last fiscal).

- A spectrum auction will be conducted in 2022 for the rollout of 5G mobile services by private telecom providers. A scheme for design led manufacturing will be launched for 5G ecosystem as part of PLI scheme to enable affordable broadband and mobile communication in rural and remote areas.

- 'One class, one TV channel' program of PM eVIDYA will be expanded from 12 to 200 TV channels. This will enable all states to provide supplementary education in regional languages for classes 1 to 12.

- Digital ecosystem for skilling and livelihood will be launched. This will aim to skill, reskill, upskill citizens through online training. API based skill credentials, payment layers to find relevant jobs and opportunities.

- An open platform for the National Digital Health Ecosystem will be rolled out. It will consist of digital registries of health providers and health facilities, unique health identity and universal access to health facilities.

- The issuance of E passports using embedded ship and futuristic technology will be rolled out in 2022-23 to enhance the convenience for the citizens in their overseas travel

Final Take

In summary, Budget 2022-23 has aimed for driving growth and stimulating private investment through higher capital expenditure. The government has stepped-up to boost the economy by spending at a time when the private expenditure remains muted in the absence of consumer demand. However, with the global inflation levels fast rising (on the back of imminent Fed rate hikes) and India’s wholesale price inflation already in double digits, it is only likely to squeeze growth further. The budget assumes crude oil prices at 70-75 dollars when it is already at 90 dollars. Any further rise will only increase the subsidy bill and leave no elbow room for the massive capital expenditure. The FM's strategy is bold and looks likely to face strong headwinds. The success of the plans, as always, boils down to effective implementation.

Reference Reading

What is the Union Budget?

The Union Budget, also referred to as the annual financial statement, is a statement of the estimated receipts and expenditure of the government for a fiscal year. It keeps the account of the government's finances for the fiscal year that runs from 1st April to 31st March. The Union Budget is typically presented on the first day of February each year and has to be passed by Lok Sabha before it can come into effect on 1st April.

The Union Budget consists of a revenue budget and an expenditure budget. The revenue budget details the money received by the government from tax and non-tax sources to enable it to undertake government expenditures. The expenditure budget details the expenditure expected to be incurred in the fiscal year for developmental and non-developmental purposes. Each Union Budget contains the details of receipts and expenditure planned for the forthcoming financial year as well as the details of receipts and expenditure incurred in the preceding financial year.

Revenue vs Capital Expenditure

Revenue Expenditures are short-term expenses used typically within one year and does not result in the creation of assets. These include payment of salaries, wages, pensions, subsidies as well as interest on loans. Capital Expenditure is that part of government expenditure that leads to the creation of assets which in turn allow the economy to generate recurring revenue and increase labour participation. This also includes repayment of loans as it reduces liability. These are expensed over many years through depreciation.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE