At the stroke of midnight on 8 Nov 2016, ₹15 trillion (USD 211 billion) worth of currency in the form of ₹500 and ₹1000 banknotes ceased to be legal tender. In one fell sweep, PM Narendra Modi with an announcement made just four hours earlier, took out 85% of India’s banknotes from circulation. In lieu, a new series of banknotes of ₹500 and ₹2,000 denomination was introduced which was exchangeable with the old banknotes upon providing specific documented proof, all within a span of 50 days. This exercise, labeled as “demonetisation”, brought with it immeasurable personal and financial suffering to Indian citizens, some of which is felt until today.

November 8, 2021 marks 5 years of demonetisation, and much water has flown under the bridge during this period. This article is not about exorcising the demons of the past but critically evaluating whether the objectives of demonetization so boldly envisioned by PM Narendra Modi have been met and the impact the exercise has had over these five years.

Making India a cashless economy

Within days of announcing demonetisation, the government after realizing the shortcomings of the scheme changed the goalpost and defended the measure as one that would make the Indian economy “cashless”. This theory too was shunned by economic experts and the goal was re-modified to make the economy a “less-cash economy”. The broader intent behind reducing physical cash transactions and increasing the use of digital payments was to bring transparency in financial transactions (which physical cash payments could not provide) and with that increase tax revenues for the government.

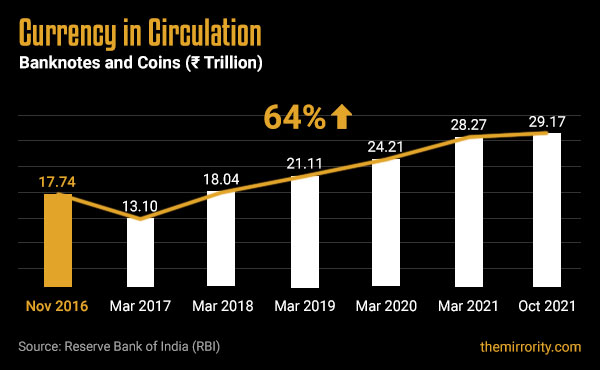

The total currency in circulation (incl notes and coins) as of 29 Oct’21 touched a record high of ₹29.17 trillion, 64% higher than ₹17.74 trillion in circulation on 4 Nov’16 (four days before demonetisation was announced). Though the value of UPI transactions too has increased from ₹0.1 trillion in 2017-18 to ₹4.1 trillion in 2020-21, cash is still king in India’s economy.

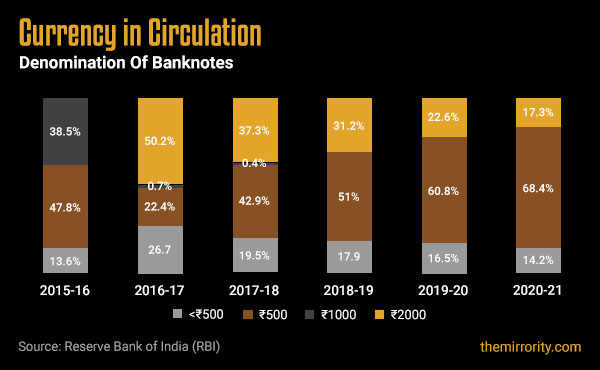

The high-denomination banknotes (₹500 and ₹1000) comprised 86.4% of the total currency in circulation as of Mar’16. The figure dipped as expected during 2016-17 when demonetisation was announced but has been climbing steadily ever since. As of Mar’21, the high-denomination banknotes (₹500 and ₹2000) comprised 85.8% of the total currency in circulation, inching close to the pre-demonetisation level. The percentage of ₹2000 banknotes which were introduced as a stopgap, is reducing however - from 50% as of Mar’17 to only 17% as of Mar’21.

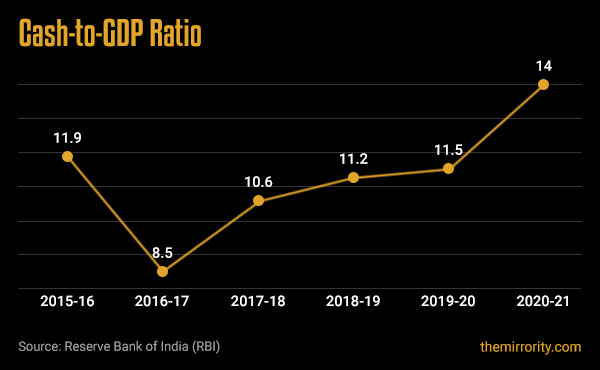

The total currency in circulation in 2020-21 was 14% of India's GDP, in comparison to the pre-demonetisation level of 11.9% in 2015-16. The government’s theory that reducing physical cash will eliminate the black economy did not have any sound academic merit. As a case in point, Japan with a 21% cash-to-GDP ratio has a small black economy while Nigeria with a 1.4% cash-to-GDP ratio has a large black economy.

Verdict: Objective not met. Instead of being cashless, India is an even greater cash-dependent economy than before demonetisation.

Also read: Money Supply (M3) and Payment Systems

Elimination of counterfeit currency notes that supports terrorism

The government believed that a significant number of banknotes in circulation were fake or counterfeit and were being used by anti-nationals to fund illegal activity and spread terrorism within India. Through demonetization, the government expected this money to be removed from circulation and thus clip the funding for terrorists. After demonetisation, only 0.0035% of the ₹1,000 banknotes were found to be counterfeit.

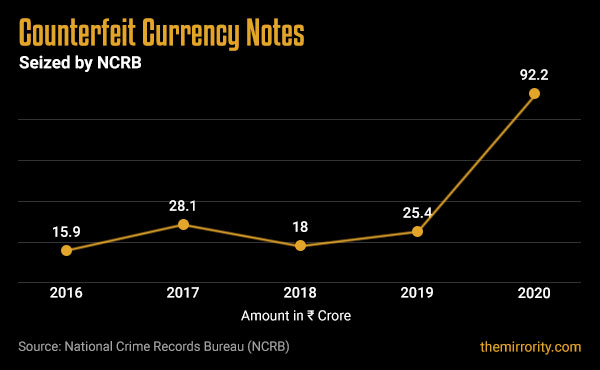

As per the national crime records, a total of 2.8 lakh fake currency notes worth ₹15.9 crores were seized in 2016. The fake currency menace has increased by 480% ever since as 8.3 lakh fake currency notes worth ₹92.2 crores were seized in 2020.

About curbed terrorist activities - while there was indeed a temporary drop in the activities and attacks by Maoist and Naxalite radical groups, their activities resumed within a few months. Five years since demonetisation, there is no material evidence of any reduction in terrorist activities that can be specifically attributed to a reduction in fake currency notes.

Verdict: Objective not met. The circulation of fake currency notes has only increased five-fold since demonetisation.

Equitable distribution of wealth

Redistribution of the illicit wealth of the rich for the upliftment of the poor and needy was a primary emotive tool used to seek the support of the masses. The exercise tapped into the raw emotion of the masses that gave them hope of greater equality in wealth between the rich and the poor as the rich would no longer be able to hoard illicit and undeclared wealth. Millions stood in queues for hours on end and faced immense hardships only because they believed the pain was temporary and achhe din (better days) lay ahead.

The government expected a windfall revenue of ₹4-5 trillion from demonetisation to give them the fiscal space to spend on welfare measures for the poor. Instead, the revenue realized was only ₹10,720 crore.

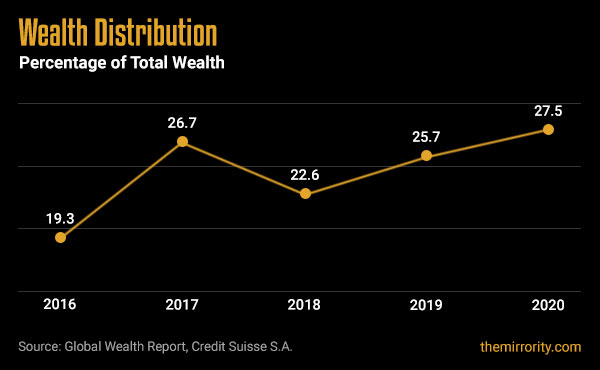

As of 2020, the poorest 90% owned 27.5% of the wealth in India while in 2017 they owned 26.7% of the total wealth. Though there is now marginally comparatively more wealth in the hands of the masses than in 2017, it cannot be attributed directly to demonetisation as it is a result of various other economic and social measures.

Verdict: Objective not met. Demonetisation failed to contribute towards equitable distribution of wealth.

Elimination of black money

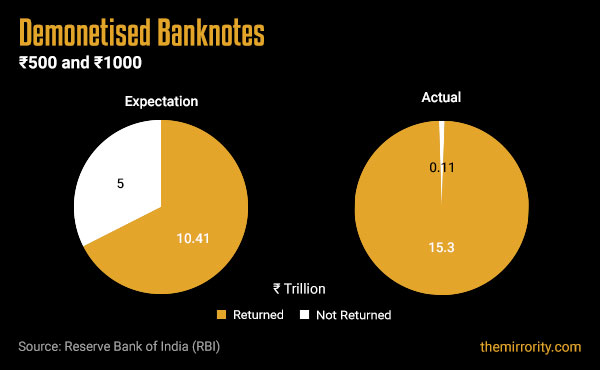

The government estimated that 20% of the demonetised banknotes would not be returned and its coffers would be richer by ₹4-5 trillion paid as dividend by the RBI.

However, according to a 2018 report from the RBI, 99.3% of the demonetised banknotes, or ₹15.3 trillion of the ₹15.41 trillion that had been demonetised, were deposited with the banking system. Only 0.7% of banknotes were not received, and the government stood to gain only ₹10,720 crores instead of ₹4-5 trillion. This gain too pales in comparison to the immediate economic loss of ₹2.3 trillion (1.5 percent of GDP) and ₹5,000+ crore to print the new banknotes. In addition, millions of poor workers lost their means of livelihood forever.

Verdict: Objective not met. Black money was not realized as expected and instead, significant losses were incurred.

Economic growth

The government believed that all outcomes of demonetisation such as elimination of black money, increase in the overall tax net, etc., would, in turn, translate into overall economic growth.

However, after 3 years of continuous growth beginning 2013-14, the GDP growth rate dipped in 2017-18, the year after demonetisation. The GDP growth rate has been on a downward spiral ever since. From a growth rate of 8.3% in 2016-17, India's GDP contracted by 7.4% in 2020-21.

Verdict: Objective not met. India's GDP growth rate has been been on a continuous decline immediately after demonetisation.

It is apparent that demonetisation was and remains a failed exercise as none of the stated objectives have been realized even after 5 years. It does not come as a surprise to most with an objective outlook. The demonetisation exercise was founded on the government’s baseless view that black money (untaxed money held in cash by tax evaders) was held in ₹500 and ₹1,000 banknotes which denied the government its due tax revenues. The resulting fallacy that all cash is thus illegitimate was unfounded as over 80% of the Indian economy comprises the unorganized sector (eg. street vendors, daily-wage laborers, single-person enterprises) which deal only in cash. Even if these transactions were to be done via cheques or digitally, they would not come under the tax bracket. A minuscule percentage of people who indeed were hoarding illegitimate cash also found a way to convert them into legitimate currency by ingeniously using their housemaids, donating to local temples, making railway bookings, bribing bank officials, etc. Once all the old notes were surrendered, the Income Tax Department identified 17.92 lakh deposit accounts as suspicious under which ₹4.2 trillion (approx. 25% of demonetised banknotes) was deposited. While IT notices were issued to these account holders, the enquiries did not yield much in hard cash as tax. So, money that was supposedly black, remained black.

At a different level, the assumption that black money is held only in cash was also without any scientific evidence or proof of logic. It is a common understanding that large tax evaders park their black money in foreign bank accounts and properties, most of which anyways comes back whitewashed into the country in the form of foreign direct investment (FDI) – a practice referred to as round-tripping. This view was even corroborated by the Central Board of Direct Taxes (CBDT) in 2012 which recommended against demonetisation, saying in a report that "demonetisation may not be a solution for tackling black money or shadow economy, which is largely held in the form of benami properties, bullion, and jewelry." According to data from income tax probes, black money holders kept less than 6% of their wealth as cash, suggesting that targeting this cash would not be a wise or successful strategy.

Economic and policy experts around the world all along held the view that bringing more people into the tax bracket required a systemic effort. They suggested changing India’s archaic and prohibitive tax laws and adopting bold policy decisions to encourage entrepreneurship and job creation instead of the brash decision of taking out 85% of India’s currency from circulation within 4 hours.

The pointless suffering on India's poorest was panned by many in the western media who openly called out the demonetisation exercise. Those in the local media wondered if this was this another of Modi’s “jumlas” (false promises) like his 2014 election promise of depositing ₹15 lakh in each Indian’s bank account through repatriation of black money hoarded abroad.

On his part, PM Modi was so sure about his decision that he promised to accept any punishment if Indians decided that they had suffered without any cause. Whether demonetisation was fruitful or a cause of pointless suffering is a decision, my fellow Indians, completely yours to make.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE