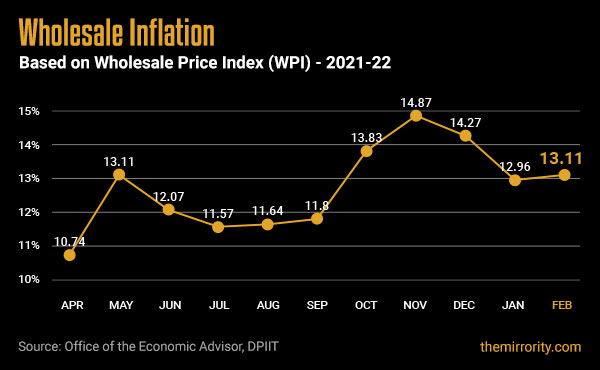

The wholesale price-based inflation, based on the Wholesale Price Index (WPI), increased to 13.11% in February. After a record high of 14.87% in November, the WPI, which measures what producers charge retailers, declined for two consecutive months in Dec'21 and Jan'22. The month of February saw the wholesale prices again begin their upward climb.

The wholesale inflation has remained in double-digits since the start of the financial year 2021-22. Looking forward, the upward momentum is expected to continue in April on the back of rising prices of crude oil which is hovering between $110 to $115 per barrel. High wholesale inflation levels are generally seen as a precursor to higher consumer prices as producers pass on rising costs to their customers. Separately, the widening gap between WPI and CPI (consumer) inflation reflects the price pressures on the inputs side which would eventually force producers to pass on the higher input and freight costs to the consumers. The RBI, in its bi-monthly monetary policy meeting last month kept its interest rates unchanged for a record 10th session (over 20 months). The continued increase in wholesale and retail prices and the rising international crude prices may keep up the pressure on interest rates prompting RBI to reconsider its stance on keeping interest rates low to support growth in its next meeting in April 2022.

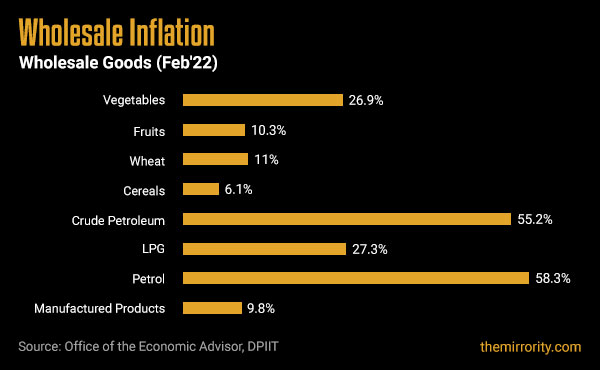

Petrol and LPG price-based inflation were higher at 58.3% and 27.3% respectively. Inflation in manufactured products, carrying the biggest weightage of 64.2% in the WPI increased by 9.8%. Within manufactured products, the wholesale prices of basic metals increased by 19.82%, textiles by 14.01%, paper & paper products by 13.29%, and chemicals and chemical products by 13.16% in Feb'22. Out of the 22 NIC two-digit groups for Manufactured products, 18 groups witnessed an increase in prices while 3 groups witnessed a decrease in prices in February as compared to January.

| Also read: Wholesale Price inflation statistics and expert analysis |

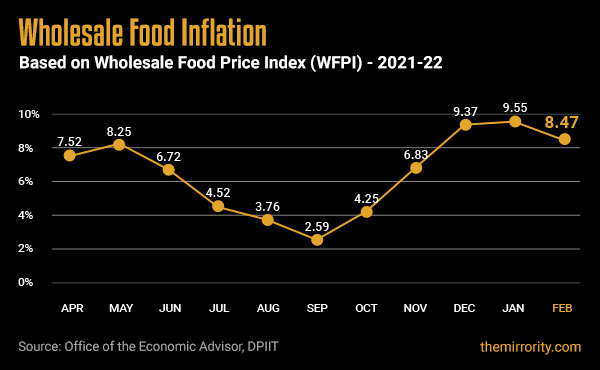

Wholesale Food Inflation

WPI has a sub-index called Food Index (WFPI), which is a combination of the Food Articles from the Primary Articles basket, and the food products from the Manufactured Products basket. As a sub-index, it broadly constitutes 24.4% of the overall Wholesale Price Index.

The Wholesale Food Price Index eased slightly from a 2-year high of 9.55% in Jan'22 to 8.47% in Feb'22. Wholesale prices of vegetables were higher by 26.9%, fruits by 10.3% while the prices of wheat increased by 11%.

Reference Reading

What is wholesale inflation?

Wholesale inflation is based on the Wholesale Price Index (WPI) which measures the changes in the price of 697 goods sold and traded in bulk by wholesale businesses to other businesses. Analysts use the numbers to track the supply and demand dynamics in industry, manufacturing, and construction. An upward surge in the WPI print indicates inflationary pressure in the economy and vice versa. The quantum of rise in the WPI month after month is used to measure the level of wholesale inflation in the economy. The wholesale price basket is broadly grouped into Primary articles, Fuel & Power, and Manufactured Goods.

- Primary articles: It constitutes 22.6% of the overall Wholesale Price Index. It is further subdivided into Food Articles, Non-food articles, Minerals, and Crude Petroleum & Natural Gas

- Fuel & Power: It constitutes 13.2% of the overall Wholesale Price Index and tracks price movements in Petrol, Diesel, and LPG

- Manufactured products: This is the biggest component basket and carries a weightage of 64.2% in the overall WPI. It comprises of a variety of manufactured products such as Textiles, Apparels, Paper, Chemicals, Plastic, Cement, Metals, etc and Manufactured Goods such as Sugar, Tobacco Products, Vegetable and Animal Oils, etc.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE