It is no surprise that the prolonged COVID crisis has exacerbated the fiscal positions of governments around the world. This is reflected in the record debt levels of many nations. In India, the pandemic has pushed many states into a debt trap and is now a matter of serious concern. At a high-level meeting with the state chief secretaries last month, the Centre red-flagged the disturbing trends in several states' finances and cautioned them.

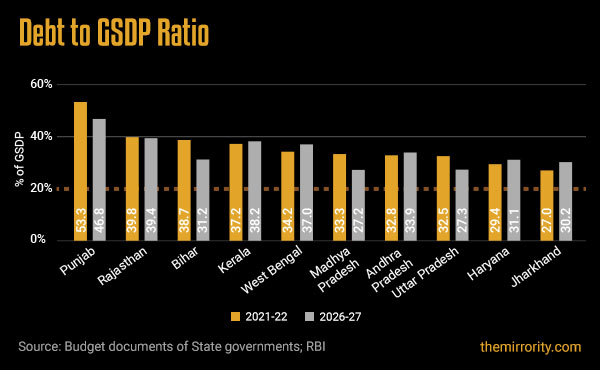

In its report published last month, the Reserve Bank of India (RBI) also put a spotlight on the fiscal risks confronting state governments in India, with particular emphasis on the heavily indebted states. The report cited ten states with the highest debt burden based on their debt to GSDP ratio i.e., debt compared to the size of their economy.

Size of Debt

Based on the debt-GSDP ratio in 2020-21, Punjab, Rajasthan, Bihar, Kerala, West Bengal, Madhya Pradesh, Andhra Pradesh, Uttar Pradesh, Haryana, and Jharkhand were the states with the highest debt burden. These 10 states account for around half of the total expenditure by all state governments in India.

The debt-GSDP ratio is projected to remain much higher than 20% as recommended by the N.K. Singh expert committee on fiscal responsibility until 2026-27. Punjab is expected to be in the worst position as its debt-GSDP ratio is projected to be almost 47 percent in 2026-27 with that of Rajasthan, Kerala, and West Bengal exceeding 35 percent.

Sources of Risk

As per RBI’s report, the major macroeconomic risks facing the state governments in India currently arise from uncertainties surrounding the evolving COVID situation, spillovers from the Russia-Ukraine war operating through high global food and commodity prices, and the monetary tightening by central banks across the world.

In addition, they are faced with a slowdown in their own tax revenue, rising subsidy burdens, expenditure on freebies, and the ballooning overdue of loss-making power distribution companies (DISCOMs). Let’s look at each of them individually.

Declining Tax Revenue

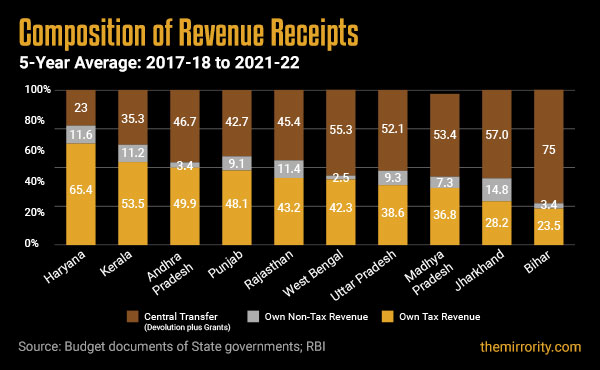

The ten states classified as stressed, account for around half of the total revenue collected by all states. Their total revenue comprises tax revenue, non-tax revenue, and central transfers, i.e., share in central taxes and grants.

The own tax revenue of Haryana, Kerala, and Andhra Pradesh constitutes about half of their total revenue collections. The major source of revenue of other states is central transfers. Within own tax revenue, states’ goods and services tax (SGST), states’ excise duties and sales tax are the major sources of revenue. For most of these states, non-tax revenue has also been dropping significantly in recent years. The decline in non-tax revenue is under general services, interest receipts, and economic services. The declining own tax revenue and non-tax revenue affect the states’ expenditure planning and increase their dependence on market borrowing pushing them further into debt.

Subsidies and Freebies

A subsidy is a direct or indirect payment to individuals in the form of a cash payment from the government or a tax cut. As per the latest available data from the Comptroller and Auditor General of India (CAG), the state government's expenditure on subsidies has grown at 12.9 percent and 11.2 percent during 2020-21 and 2021-22, respectively, after contracting in 2019-20. Commensurately, the share of subsidies in total revenue expenditure by states has also risen from 7.8 percent in 2019-20 to 8.2 percent in 2021-22. Jharkhand, Kerala, Odisha, Telangana, and Uttar Pradesh are the top five states with the largest rise in subsidies over the last three years. States like Gujarat, Punjab, and Chhattisgarh spend more than 10 percent of their revenue expenditure on subsidies.

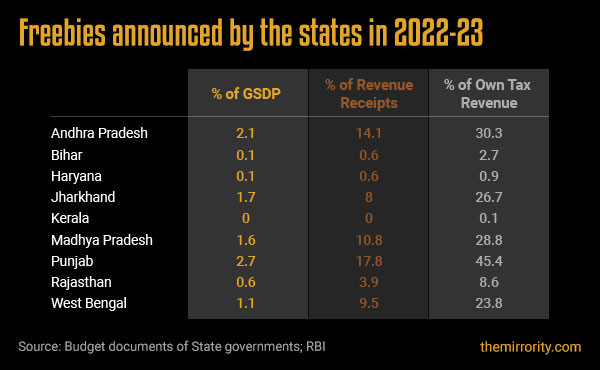

It has been observed of late that state governments have started delivering a portion of their subsidies in the form of ‘freebies’. Examples of freebies include the provision of free electricity, free water, free public transportation, waiver of pending utility bills, and farm loan waivers. Freebies have a tendency to undermine credit culture, distort prices through cross-subsidization, and erode incentives for private investment. Some freebies may also benefit the poor if properly targeted with minimal leakages.

The freebies have exceeded 2 percent of GSDP for some of the highly indebted states such as Punjab and Andhra Pradesh.

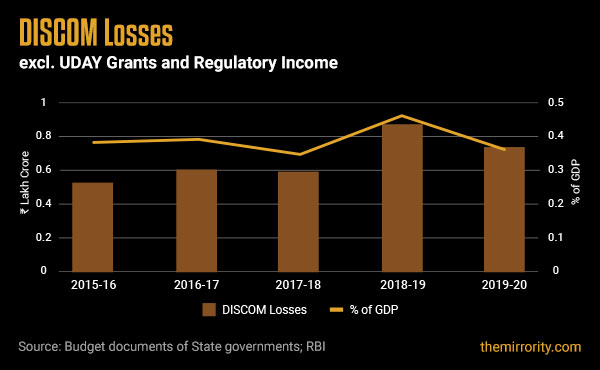

DISCOMs Bailout

The power sector accounts for much of the financial burden of state governments in India. Many state governments provide subsidies, artificially reducing the cost of electricity for the farm sector and a section of the household sector. State governments also periodically infuse capital into power distribution companies (DISCOMs) to enable them to undertake productive investments and compensate them for their losses.

Despite various financial restructuring measures, the performance of the DISCOMs has remained weak. The combined losses of DISCOMs in the five most indebted states (Bihar, Kerala, Punjab, Rajasthan, and West Bengal) constituted 24.7 percent of the total DISCOMs losses in 2019-20, while their combined long-term debt was 22.9 percent of the total DISCOM debt in 2019-20. The total overdue of states towards power generation companies, excluding state-owned ones, is Rs 1,01,442 crore.

Reducing DISCOM losses means increasing the electricity tariffs which the states are reluctant to do to protect their vote banks. The telecom rates have increased by up to 30% in the last 3 years while the electricity rates have not.

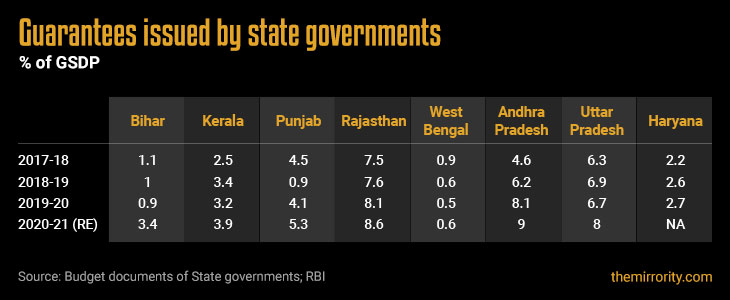

Contingent Liabilities

Contingent liabilities are the contractual obligations of the government to pay in the event of a default by the borrower.

The off-budget borrowings by states - loans raised by state-owned entities and guaranteed by the state governments - have reached around 4.5 percent of GDP in 2022. The power sector accounts for almost 40 percent of these guarantees. These were taken to repay the dues of power generation and transmission companies with DISCOMs continuing to make cash losses. Other beneficiaries include sectors like irrigation, infrastructure development, and food and water supply. Contingent liabilities have surpassed 5 percent of GSDP in states like Punjab, Rajasthan, Uttar Pradesh, and Andhra Pradesh.

How are states funding the deficit?

Under Article 293 (3) of the Constitution, state governments are required to take the Centre’s permission for fresh borrowing, if they are indebted to the Government of India. A fiscal deficit target is typically recommended by the Government of India-appointed finance commission for a five-year period and accepted or modified by the Centre.

In order to fund the deficit, states have begun taking loans secured against assets like municipal parks, collector's offices, taluk offices, courts, hospitals etc. Entities that do not have revenue streams to service the loans are getting loans based on state government guarantees and/or security of land or escrow of state revenue.

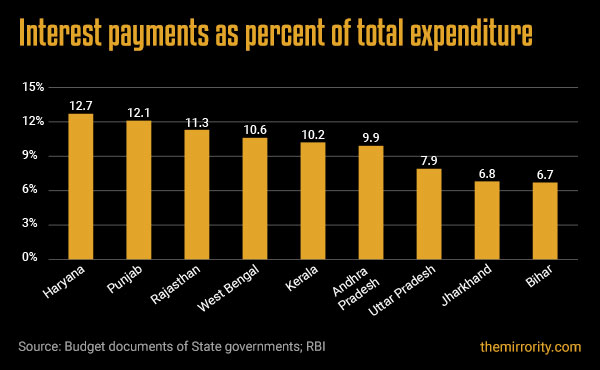

The impact of such heavy borrowing is that the burden of debt servicing eats into the annual budget leaving little headroom for the states to spend on other developmental activities. ₹68,828 crore (41% of the total expenditure budget) was budgeted by Punjab in 2021-22 for debt servicing. Of this, ₹20,316 crore was budgeted for interest payable on Punjab's accumulated debts, comprising 12.1% of the total expenditure budget. In absolute terms, 30% of the total amount paid by Punjab for debt servicing between 2013 and 2020 was only the interest component.

Conclusion

The slowdown in own tax revenue, the burden of rising subsidies and freebies, expanding contingent liabilities, and the ballooning overdue of DISCOMs have stretched state government finances already exacerbated by COVID-19. For most of the highly indebted states, the debt is no longer sustainable, as the debt growth has outpaced their GSDP growth in the last five years. Stress tests show that the fiscal conditions of the most indebted state governments are expected to deteriorate further, with their debt-GSDP ratio likely to remain above 35 percent in 2026-27.

The Centre’s GST compensation payout will cease in June 2022 which will further reduce the states’ capacity to undertake social sector expenditure. Given the state’s penchant for freebies, it will sink them further into a debt trap.

Unlike the Union government, the state governments do not have the power to print money and nor can they borrow from foreign sources. As per the recommendations mentioned in RBI’s report, the state governments must adopt some of the below corrective measures to improve their financial position:

- Reprioritize expenditures to achieve optimum long-term welfare advantages by ensuring that the beneficiaries get empowered permanently and forego such benefits.

- Incorporate a sunset clause for each social sector scheme. Reducing the quantum of subsidies by ensuring that only the deserving receive them will free up resources to invest in health, education, agriculture, R&D, and rural infrastructure, which will help create more jobs and reduce poverty on a sustainable basis.

- Restrict revenue expenses by cutting down expenditure on non-merit freebies in the near term.

- Introduce large-scale reforms in the power distribution sector that would enable the DISCOMs to reduce losses and make them financially sustainable and operationally efficient

- Increase the share of capital outlays in the total expenditure that will help create long-term assets, generate revenue, and boost operational efficiency.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE