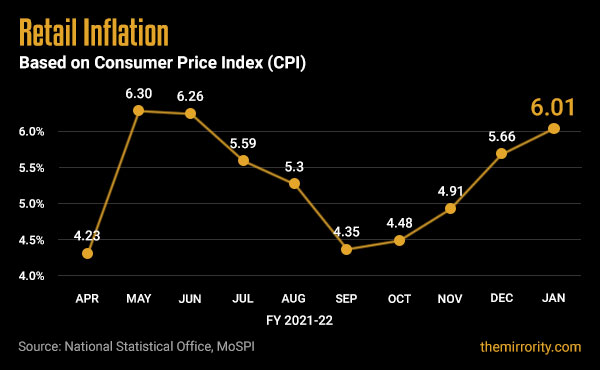

Retail inflation in India, measured by the Consumer Price Index (CPI) increased to a seven-month high of 6.01% in January, based on the latest data released by the government. The rising inflation levels, especially in the midst of the third wave of the pandemic and weakening aggregate demand, are expected to further squeeze disposable incomes making things even more challenging for the monetary policymakers.

At 6.01%, retail inflation in January has crossed RBI’s comfort boundary of 6% set last year to maintain the existing interest rates. In order to dispel any cause of panic, RBI Governor Shaktikanta Das said earlier yesterday that India's inflation projections are robust and all possible scenarios in the oil price range have been taken into account. "Price stability is of uppermost priority," he added.

In its bi-monthly monetary policy review last week, RBI had kept its key policy rates unchanged for the tenth time in a row, maintaining an ‘accommodative stance’ to support growth. While the RBI Governor's call for calm is palpable, the rising inflation and the fast-increasing international crude prices will weigh heavily at RBI's monetary policy meetings in the coming months. The RBI has maintained an upper tolerance level for retail inflation at 4.5% in the next fiscal year beginning April 2022.

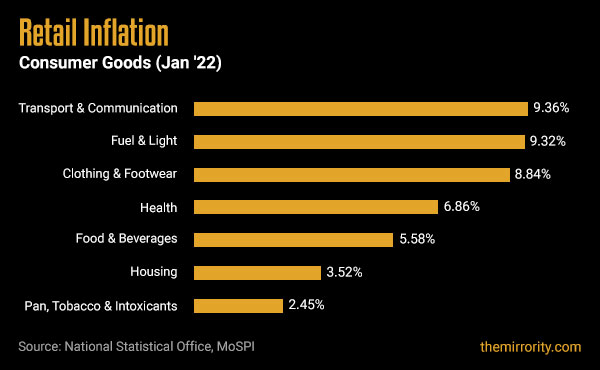

Higher inflation levels due to price increase were felt particularly in Transport & Communication (9.36%) which comprises 7.6% of the overall weight in the consumer price basket. Fuel & Light increased by 9.32% in Jan'22, in comparison to 10.95% in Dec'21. Clothing & Footwear increased by 8.84%, Health by 6.86%, while Food & Beverages increased by 5.58%. Inflationary pressure in Housing eased marginally from 3.61% in Dec'21 to 3.52% in Jan'22 while Pan, Tobacco & Intoxicants eased from 3.16% in Dec'21 to 2.45% in Jan'22.

Food Inflation

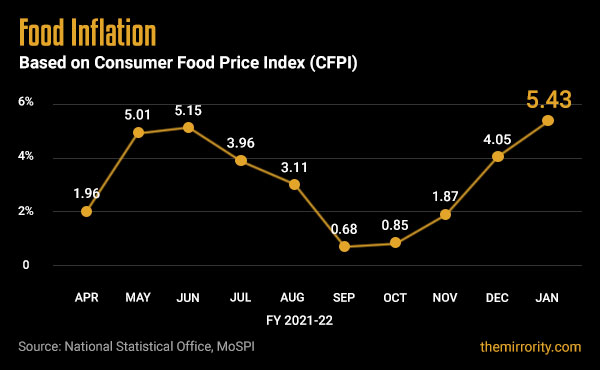

Food Inflation, determined by the Consumer Food Price Index (CFPI), measures changes in retail prices of food items consumed by the population. CFPI commodities comprise 39.05% of the entire CPI basket.

Food inflation rose to a 14-month high of 5.43% in Jan'22. The rise in January's food inflation is a result of an increase in the prices of all food items. Prices of edible oil climbed 18.7%, meat and fish prices increased by 5.47% while vegetable prices increased by 5.19%.

| Also read: Retail inflation statistics and expert analysis |

States-wise Inflation

.jpg)

Haryana recorded the highest level of increase in retail prices at 7.23% in January for the second straight month. West Bengal and Jammu & Kashmir followed closely at 7.11% and 6.74% respectively. Retail price pressure was the lowest in Punjab at 4.09%, followed by Kerala at 4.36%.

Reference Reading

What is retail inflation?

Retail inflation, also called consumer inflation, is a general rise in prices of consumer goods where a unit of currency effectively buys lesser goods and services, resulting in an overall drop in purchasing power in an economy over a period. More commonly, people refer to inflation as "the rising cost of living". A prolonged period of inflation occurs when a nation's money supply growth outpaces economic growth. Generally, people's perspective on Inflation differs based on their economic position. Those with tangible assets, like property or commodities, may prefer some level of inflation as that raises the value of their assets. People holding cash may not like inflation, as it erodes the value of their cash holdings. A country always aims to maintain an optimum level of inflation to promote spending to a certain extent instead of saving, thereby nurturing economic growth. In India, the Reserve Bank of India (RBI) uses consumer inflation as a key measure of inflation to set the monetary and credit policy.

How is retail inflation calculated?

Consumer inflation is based on the Consumer Price Index (CPI). It measures the weighted average of prices of a basket of 260 goods and services which are of primary consumer needs, such as food, transportation, education, fuel, etc. Changes in the CPI are used to assess price changes associated with the cost of living. Prices of sample goods and services are collected every month from 1000-1200 urban markets and villages by field staff of Field Operations Division of NSO, MoSPI, and the change, if any, is noted. The annual percentage change in a CPI is used as a measure of inflation. Consumer price changes in India can be very volatile due to dependence on energy imports, the uncertain impact of monsoon rains on its large farm sector, difficulties transporting food items to market because of its poor roads and infrastructure, and high fiscal deficit.

The CPI basket comprising 260 commodities including certain services is grouped under 11 heads - their weightage in the basket is mentioned in brackets: Food and beverages (45.86%), Transport and communication (8.59%), Health (5.89%), Education (4.46%), Housing (10.07%), Fuel and light (6.84%), Clothing and footwear (6.53%), Pan, tobacco and intoxicants (2.38%), Household goods and services (3.80%), Recreation & amusement (1.68%), Personal care and effects (3.89%).

Example of Retail Inflation

Let's assume 1 kg of apples cost ₹ 10 in the year 2000. Thus, ₹100 could have fetched 10 kgs of apples. In the year 2020, 1 kg of apples cost ₹20 where ₹100 could fetch only 5 kgs of apples. Although the value of ₹100 note remained the same, it lost its purchasing power by 50% over the 20-year period. This phenomenon is called inflation. However, it is not necessary that prices always rise with time as they may remain steady or even decline. Using the same example above, if the price of apples is reduced to ₹5 per kg in 2020, the same ₹100 note could fetch 20 kgs of apples. In this case, the purchasing power of the ₹100 note increased over the period as the price of the commodity declined. This phenomenon is called deflation and is the opposite of inflation.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE