India is the world’s third-biggest consumer of oil, after the United States and China, and relies on imports for over 85% of its consumption. International crude prices have increased by over 20% since December and are now at a 7-year high.

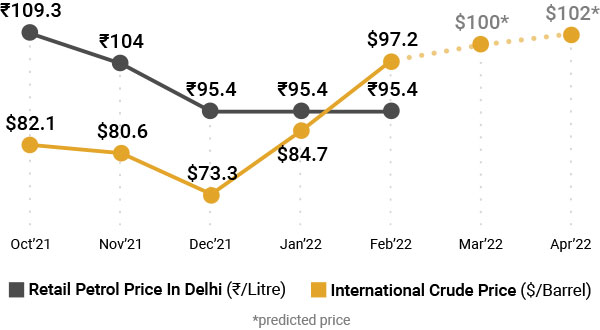

Oil prices (Indian basket) have increased from $80.64 in early November to $97.21 as of February 22. However, petrol and diesel prices in India have remained stagnant since November 4. Global experts and analysts predict oil prices to soon touch $100 and remain above the $100 mark for the next couple of months. The divergent issue of rising crude oil prices on one end and the minimal bandwidth to increase retail fuel prices on the other pose a major socio-economic challenge for India.

Why are oil prices rising so quickly?

Oil prices are influenced by a variety of factors such as international political situations, demand-supply gaps, fluctuation in dollar exchange rates, and local taxation. The climb in international oil prices over the last few months to reach a 7-year high can be attributed to the below key factors:

- Rise in international demand: Global experts predicted the demand to return to pre-covid levels only by Q4’22 or Q1’23 but economies around the world have demonstrated an eagerness to get back to pre-covid levels much quicker and catch up on the losses imposed by the pandemic. Most countries have completely removed the ban on public gatherings and lifted travel restrictions. As per the predictions by the Petroleum Planning and Analysis Cell of India, domestic demand is expected to rise by 5.5% in 2022-23 compared to a year ago. The existing global supply is unable to keep up with the demand unless the Organization of the Petroleum Exporting Countries (OPEC) agrees to pump more oil. Any immediate change in the decision by Opec to pump more oil will also take a few months before it can affect oil prices.

- Geopolitical tensions in Eastern Europe: The growing political tensions between Ukraine and Russia have created ripples around the world. The US has imposed sanctions on Russia while other neighboring nations are expected to be dragged into the crisis one way or the other. Russia, being a major oil-producing nation, could use it as leverage to mitigate the sanctions and soften the international backlash.

Why is India not increasing domestic fuel prices?

International oil prices have increased by $16.5 per barrel since November. Experts estimate that every $1 increase in international oil prices has a corresponding impact of ₹0.5 per litre on India’s retail fuel prices. However, domestic retailers such as Indian Oil, Bharat Petroleum, and Hindustan Petroleum, which collectively control 90% of the domestic market, did not increase the retail prices of petrol and diesel, despite being legally allowed to do so. Petrol and diesel prices in India have remained stagnant since November 4.

The central and state governments absorbed the impact by cutting excise duty and Value Added Tax (VAT). On November 3, the central government cut the excise duty on petrol and diesel by Rs 5 and Rs 10 respectively. Subsequently, the state governments cut the VAT to further cushion the blow.

One of the key reasons to hold on to the price hike was that 5 states (Uttar Pradesh, Punjab, Uttarakhand, Goa, and Manipur) were due to go to polls within the coming 3 months and a price hike could be seen as catastrophic for the ruling government.

What happens now?

Once election results are announced on March 10, any of these “could” materialize in the coming weeks.

- Petrol and diesel prices could increase by Rs 7-8 per litre: It is likely that the government could partially absorb the impact. However, this could lead to higher government borrowings and increase the likelihood of the fiscal deficit target of 6.4% for 2022-23 being breached. For the consumers, it could lead to reduced disposable incomes. Given that private consumption accounts for 58% of India’s GDP, this could have a significant impact on economic growth.

- Consumer inflation could shoot over 6%: The RBI has kept its interest rates unchanged for over 20 months now given that the consumer inflation (price rise of basic goods) was below 6% (the comfort boundary of RBI). An increase beyond 6% could prompt RBI to raise interest rates and increase borrowing costs for businesses. This could have a knock-on effect on the economy as a whole.

- Cut down on the record infrastructure spends budgeted for 2022-23: The budget for 2022-23 was based on an average fuel price between $70-75. Higher oil prices could restrain the government’s ability to spend to boost the economy that will have a knock-on effect in generating much-needed employment opportunities.

- The GDP target could be affected: It is estimated that every $10 increase in oil price has the potential to impact India’s economic growth by up to 0.4%.

Not all is as gloomy though. There are a few positive signs of the oil prices reducing too. The US and Iran are in active talks to have sanctions lifted that would allow Iran to sell its oil in the open market. If the deal with Iran comes through, the oil prices could reduce by up $5-10 a barrel. If the discussions do not materialize, the prices as mentioned earlier seem all set to cross $100 a barrel and remain above that level for the next few months.

There is one industry segment though that should not be complaining as much - the oil refineries. With skyrocketing oil prices and their high margins, this could prove to be just the bonanza they were waiting for over the last decade.

How can India mitigate the impact?

There are some sections of society that have called for fast-tracking India’s renewable energy goals. Renewable sources comprised 24.6% of the total installed capacity in 2021, in comparison to 17.5% in 2017. While India is making progress in increasing its renewable energy capacity, it would take a while for it to materially impact India’s fuel imports.

A Performance Linked Incentive (PLI) scheme and tax incentives are in place to help auto-manufacturers switch to electric vehicles. However, given the poor charging infrastructure and affordability of electric vehicles, its ability to reduce India’s fuel import bill is a few years away.

The government has already announced its plans for converting sugar into biofuel. While this measure will help manage the excess sugar stockpiles and augment farmer incomes, it is unlikely to have a big impact on India’s oil import bill anytime soon.

In summary, there are no quick fixes that could help protect us from the increasing international oil prices and India is not alone in feeling the impact. The impact on India is comparatively higher though given the size of its oil imports. As the saying goes, “desperate situations call for desperate measures.” Maneuvering India out of this situation will require some ingenious thinking and political bipartisanship by our leaders.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE