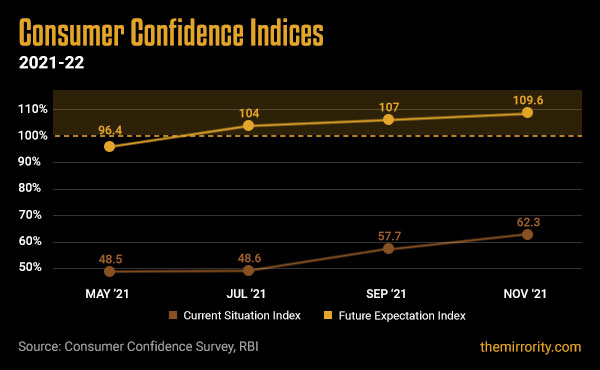

The latest round of Consumer Confidence Survey conducted by the RBI for the months of October and November showed consumers’ confidence recovering from the historic lows touched in May 2021, though it continues to remain in the pessimistic terrain.

The consumer confidence survey was conducted between October 25 and November 3 from 5,310 households in 13 major cities (Ahmedabad, Bengaluru, Bhopal, Chennai, Delhi, Guwahati, Hyderabad, Jaipur, Kolkata, Lucknow, Mumbai, Patna, and Thiruvananthapuram).

The Current Situation Index (CSI) reflecting consumer sentiments about current economic, employment, and price conditions as compared to a year ago increased to 62.3 in November from 57.7 in September. While consumer confidence in the current situation has improved over the last 2 months, it remains pessimistic overall.

The Future Expectation Index (FEI) reflecting consumer expectations about economic, employment, and price conditions a year ahead rose to 109.6 in November from 107 in September. This shows that households are now even more confident for the year ahead. A value above 100 indicates higher consumer confidence (optimism) and a value below 100 indicates lower consumer confidence (pessimism).

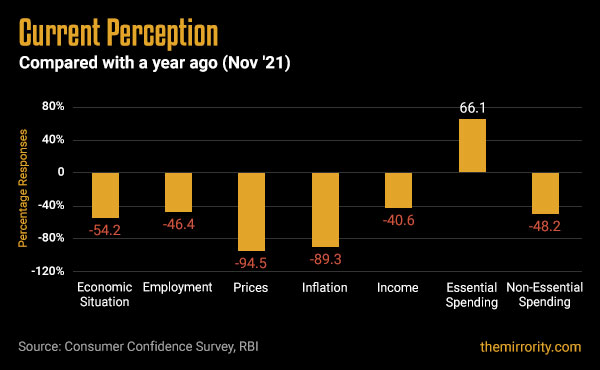

Current Perception

The increased consumer optimism in the current situation compared to a year ago is mainly due to the rise in consumer spending on essential commodities. However, current perceptions on the economic situation, employment, price level, income, and non-essential spending are still in the negative terrain.

The current perception of the economic situation, though still negative, showed improvement at -54.2 in November from -57.4 in September. The perception for employment too showed improvement at -46.4 in November from -57.6 in September. However, the perception of the price level and inflation deteriorated compared to the last round of the survey in September. 94.5% of net survey respondents in November believe that the current price levels are high in comparison to a year ago while 89.3% of net survey respondents in November believe that the inflation levels are even less favorable compared to a year ago.

Economists believe that the growth in spending was fueled by the decline in Covid cases from September that saw businesses being opened across the country to cater to the pent-up demand leading to more footfalls in malls and markets. According to RBI data, the credit disbursement in the two fortnights ended 5th November 2021 (covering Diwali, Dussehra, and Navratri) amounted to ₹1,50,278 crore, in comparison to ₹81,361 crore a year ago.

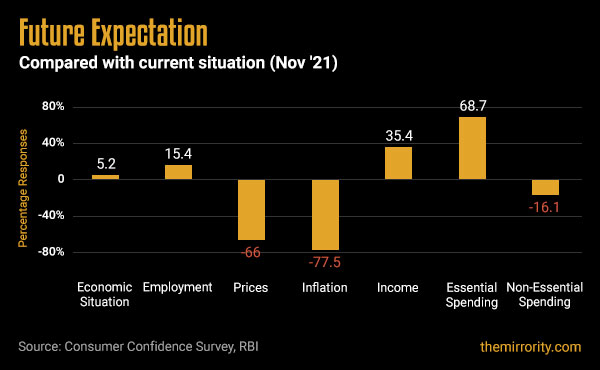

Future Expectation

Consumer confidence was even higher for the year ahead buoyed by higher optimism for household income and employment conditions.

The expectations for the employment scenario for the year ahead improved to 15.4 in November from 7.9 in September while that for income increased to 35.4 in November from 31.3 in September. 5.2% of net survey respondents in November expect the overall economic situation to improve in the year ahead in comparison to only 1.5 holding the same view in September. However, sentiments on consumer prices, inflation, and non-essential expenditure deteriorated further and remained in the pessimistic territory.

Reference Reading

Consumer confidence is an economic indicator that measures the degree of optimism or pessimism that consumers feel about the overall state of the economy and their personal financial situation. It is a widely-used economic indicator, which serves as a barometer of the health of the economy from the perspective of the consumer. When consumer confidence in the economy is high, consumers make more purchases and save less. When confidence is low, consumers tend to save more and spend less.

The consumer confidence is measured through a bi-monthly Consumer Confidence Survey (CCS) conducted by the Reserve Bank of India (RBI). The survey obtains information on urban consumer sentiments and captures qualitative responses to questions pertaining to general economic conditions, household circumstances, income, spending, prices, etc. For each round of the survey, approx. 5400 respondents (aged 21 years and above) are canvassed in metropolitan cities such as Bangalore, Chennai, Delhi, Hyderabad, Kolkata, and Mumbai

The CCS responses are measured through two indexes:

- Current Situation Index (CSI) captures consumer sentiment about current economic, employment, and price conditions as compared to a year ago. When the CSI shows current economic sentiment as positive, it can be viewed as a positive signal that the economy is strong or in recovery. Businesses, investors, and entrepreneurs can use this information (along with other market-specific indicators) to help gauge near-term demand for their products. Economic policymakers also consider consumer sentiment in setting targets on things like interest rates and monetary policy.

- Future Expectation Index (FEI) captures consumer expectations about economic, employment, and price conditions a year ahead. Businesses often use it to help make better-informed decisions or adjustments in strategy such as investments in new projects or the launch of new products.

TO READ THE FULL ARTICLE

Get full access to the exciting content on The Mirrority by logging in

Support independent journalism

Even the very best of media houses in our country today are yielding to the pressure of click-bait journalism in order to survive. More than ever before, our country needs journalism that is independent, fair and non-pliant to the bureaucracy. Such journalism needs the support of like-minded readers like you to help us survive editorially and financially.

Whether you live in India or India lives inside you, help us continue to produce quality journalism with your contribution.

CONTRIBUTE